“Sometimes the questions are complicated and the answers are simple.” — Dr. Seuss

2024 came out swinging. The S&P 500 rose more than 10% in the first quarter after adding more than 11% in the fourth quarter of 2023. Back-to-back double-digit quarters are rare, but they tend to happen in bull markets.

- The S&P 500 advanced for the third consecutive week, adding 1.9% and approaching an all-time high.

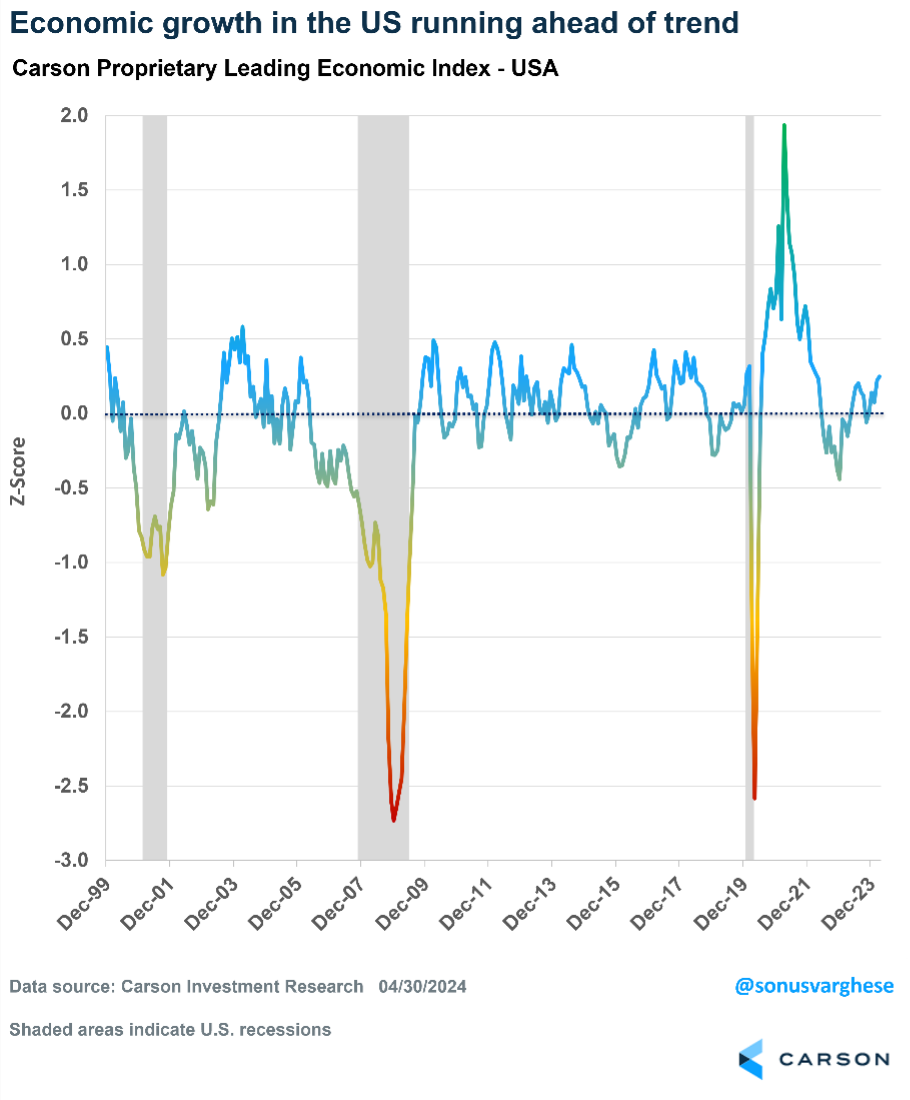

- Economic data remains supportive, according to the Carson Leading Economic Indicator, which is pointing to above-trend growth.

- Strong starts to the year are bullish signals, and this bull market is young.

- Stocks tend to do well when an incumbent president is up for reelection.

- Earnings and profit margins remain strong.

- Inflation continues to normalize despite recent disappointments and is being outpaced by wage growth.

April is usually a bullish month, but this time the S&P 500 fell 4.2%, which included a 5.5% mild correction mid-month. While some cracks may be forming, the economy remains on firm footing. What could be next for stocks? We’ve been overweight equities since December 2022 and remain there today, as we expect to see stocks move to new highs this summer and the bull market to continue.

Here are seven reasons we think the bull market is alive and well.

Our Leading Economic Indicators Still Point to a Strong Economy

A couple of softer-than-expected economic report cards recently came in — first quarter GDP growth and the April payroll report — and suddenly, calls for an impending recession have resumed. In fact, the combination of these reports with hotter-than-expected inflation in the first quarter, has raised chatter about the dreaded stagflation scenario of low growth and high inflation.

Let’s be clear. We’re nowhere close to a recession, let alone stagflation. Stagflation is typically accompanied by high unemployment rates, whereas the unemployment rate has been below 4% for 27 straight months, the longest streak since the 1960s. Also, a stagflation environment is one where inflation is running in the high single digits, if not higher. While first-quarter inflation was hotter than expected, headline inflation was up 2.7% (using the Fed’s preferred personal consumption expenditures metric) through March. A year ago, it was up 4.4%. That’s the big picture on inflation.

The evidence is clear: We are not in a recession, nor are we close to one. The “soft” GDP number hid underlying strength, as most of the weakness was in the numbers that tend not to persist, and the payroll report was quite positive even if it missed expectations.

Admittedly, it can be hard to get a full picture of the economy as the data rolls in week after week. This is why we have our own Carson Leading Economic Indicator (LEI) for the U.S. and 28 other countries. Domestically, the LEI includes more than 20 components that capture the dynamics of the U.S. economy. These include:

- Consumer-related indicators

- Housing indicators

- Business and manufacturing activity

- Sentiment

- Financial markets

The Carson LEI indicates whether the economy is currently growing below trend, above trend, or on trend. An LEI value near 0 would be on trend and represent typical growth. Think of it as a nowcast of the economy as opposed to a forecast. In other words, we’re trying to figure out what the economy is doing currently, which can be hard enough as opinions vary, instead of figuring out what the economy will be doing six to 12 months from now, which can be even more difficult. And since economic conditions typically don’t change on a dime (except in March 2020 due to COVID-19), we’re comfortable projecting that view over the near term (one to three months), all while continuously updating our index with new data.

As the chart below shows, our LEI can warn us of a recession ahead or at its early onset. Importantly, it did not point to a recession in 2022 or 2023, which is why we maintained that the U.S. would avoid one. Currently, the U.S. LEI points well away from a recession. The index has been rising in recent months, indicating above-trend growth.

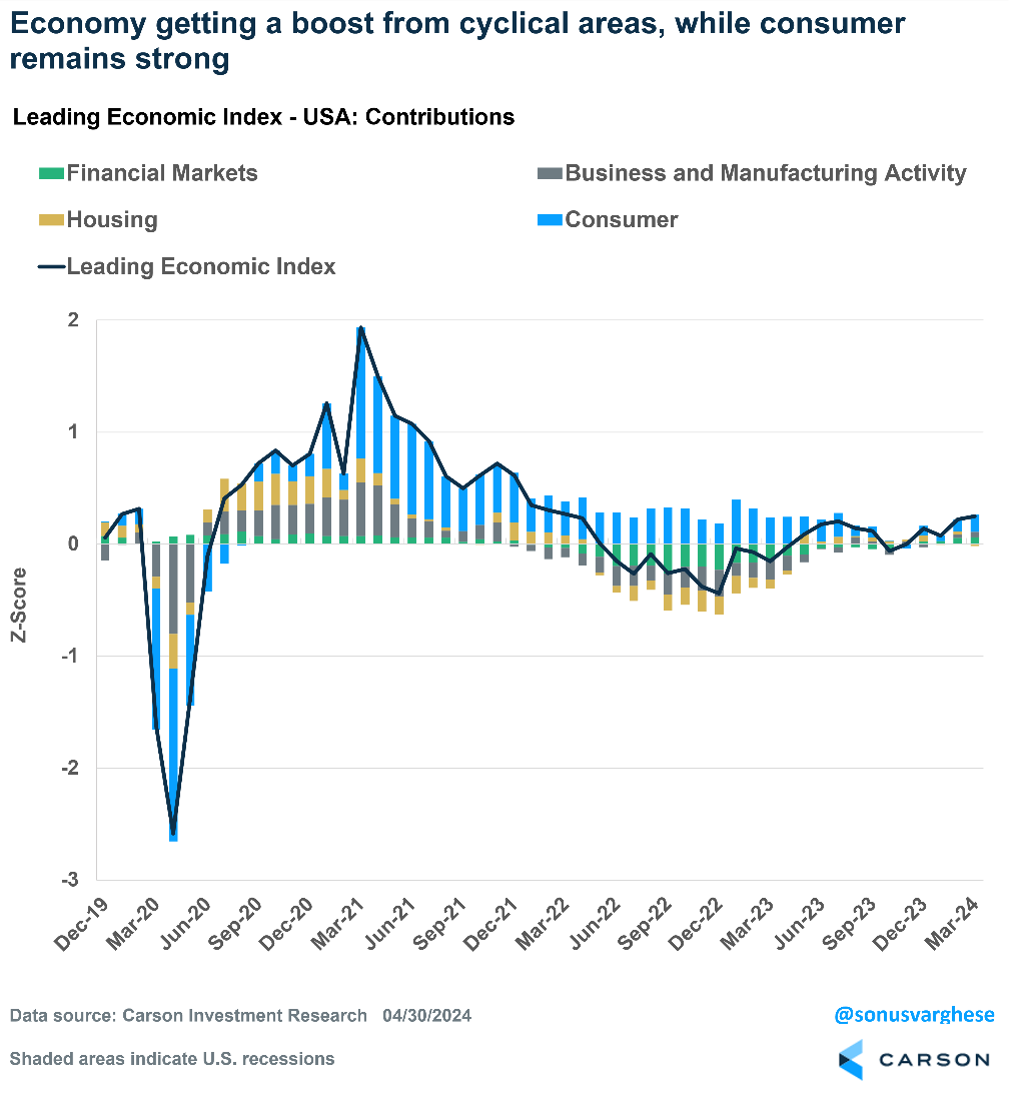

The recent upswing has occurred on the back of a strong consumer, coupled with rising investment spending. Housing is no longer a drag, as it was in 2022 and most of 2023. The economic picture is certainly better than it was a year ago when concerns were rampant about a potential banking crisis after the collapse of Silicon Valley Bank. The banking system has held up, and economic growth has run ahead of the pre-pandemic 2010-2019 trend. We were able to capture this in real time using our LEI.

In a nutshell, here’s what has happened since 2022 when the Fed started aggressively raising interest rates, all captured in our LEI:

- Contrary to most forecasts, the economy avoided a recession in 2022-2023 thanks to strong household spending, which more than offset the drag from tighter interest rates despite their impact on housing and business investment.

- In the second half of 2023 and into 2024, the cyclical areas of the economy — business investment and housing — started to recover and add to GDP growth, even as consumption remained above trend and buoyed by a strong labor market.

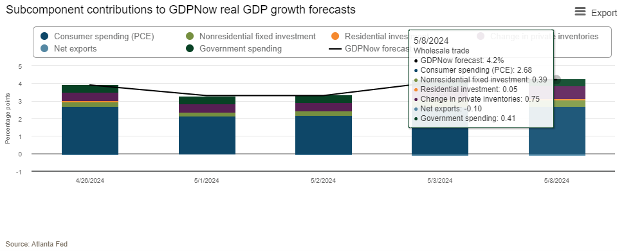

The Atlanta Fed’s GDPNowcast for second-quarter GDP growth is currently at a whopping 4.2%. It’s early days yet and we still have a couple of months’ worth of data to review for the second quarter, but so far the data points to strong growth. In fact, after removing the volatile parts of GDP — inventories and net exports — as well as government spending, the nowcast puts “real final private demand” (spending by households and businesses) at 3.1%. For perspective, that is the same pace as it was in the first quarter and higher than the 2.4% trend between 2010 and 2019.

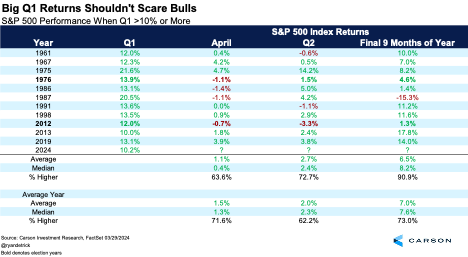

Big Starts to a Year Are Bullish

The S&P 500 recently underwent a correction after a five-month win streak. This was after many bears had turned bullish. With that kind of setup, it makes sense that some volatility was necessary to shake the tree. Even though the S&P 500 pulled back just more than 5%, many of the former highfliers saw much larger corrections.

As for the big start, we reviewed other years that gained double digits in the first quarter and found that stocks were higher the rest of the year (the final nine months) 10 out of 11 years. The one negative year was 1987, but stocks were up 40% by August that year, so we don’t see that repeating. The average return is skewed due to 1987, but the median return for the rest of the year is a solid 8.2%, better than the median return for all years. Bottom line: A big start to a year is not a reason to become bearish. In fact, historically it signals additional strength.\

This Bull Market Is Still Young

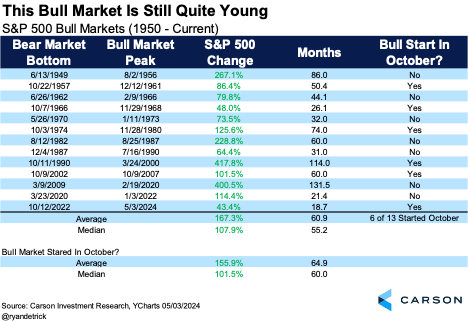

The current bull market started in October 2022, which means it is now just less than 19 months old. If it ended now, it would be the shortest bull market ever. Most bull markets last much longer. The last 12 bull markets have averaged more than five years. Taking this a step further, many bull markets started in the so-called “bear market killer” month of October (this one included), and those bull markets have lasted even longer.

The current bull market is up more than 40%, which might feel significant, but the four bull markets that have occurred since 1990 at least doubled. History suggests we should be open to a much longer bull market and potentially large gains along the way.

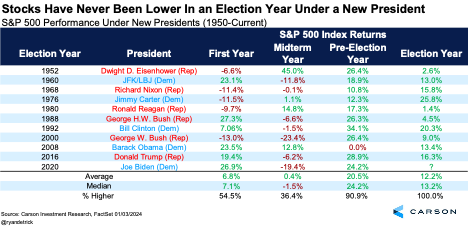

Stocks Like a President Up for Reelection

The last 10 times a president was up for reelection stocks finished the year higher. Election years with a lame duck president is when things didn’t go as well.

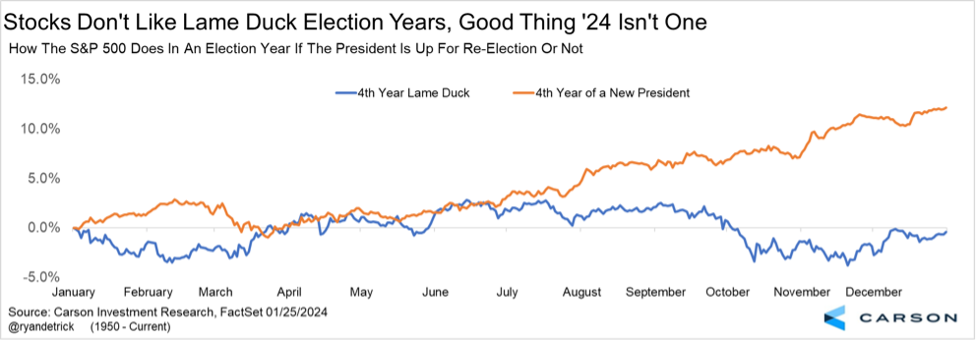

A surprise summer rally is normal when the president is up for reelection. This chart shows how strength the rest of this year is likely with a president up for reelection, while trouble brews when the president is a lame duck.

It’s All About Earnings

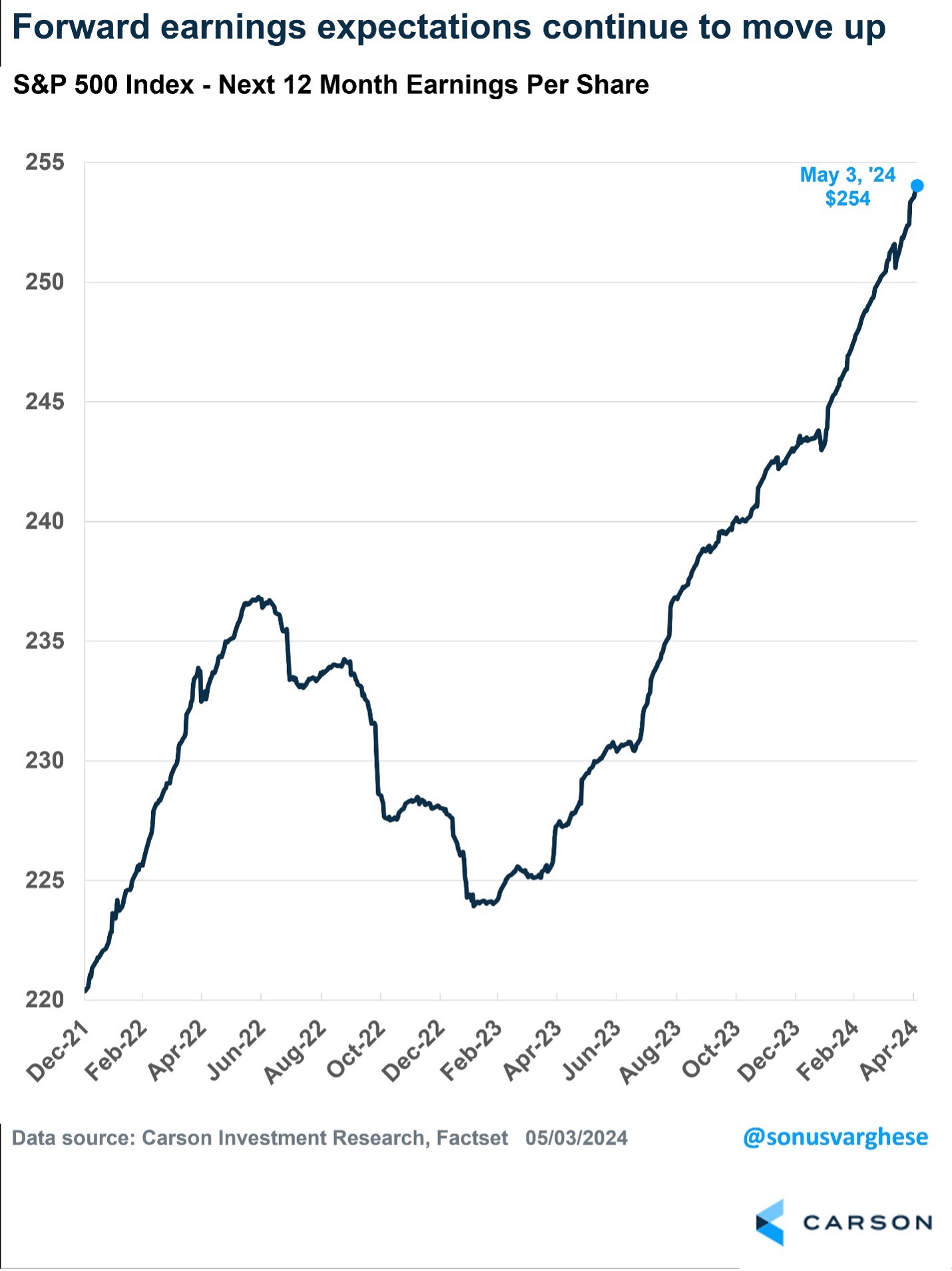

Earnings drive long-term stock gains, and the current backdrop continues to appear strong. The still-healthy consumer, strong labor market, potential for lower rates boosting the housing market, and improving manufacturing all suggest an economy that could surprise to the upside for the rest of 2024. Nominal GDP came in near 6% last year for one of the best years in recent memory, but the stage is set for similar growth this year. Remember, nominal GDP growth leads to profit growth, and profits matter.

S&P 500 first-quarter earnings are up more than 5.0% currently, from 3.2% expected at the start of the quarter, according to FactSet. This would be the best earnings growth in nearly two years, while revenue is higher for the 14th quarter in a row.

Corporate profits for the S&P 500 are expected to hit an all-time high this year, with a gain of close to 11%. Periods of strong productivity, such as we are seeing now, tend to come in better than expected, and we think 11% could be a tad low as a result. The mid-to-late ‘90s saw strong productivity and consistently better-than-expected earnings and GDP. It was the last decade, when productivity was low, that GDP disappointed consistently in the 2% range. Look at the quote at the top one more time: The easiest answer is earnings are strong, and that is likely why stocks have been strong!

Many analysts are coming in too low with earnings estimates, as they are still skeptical of this recovery. Looking out a year, forward 12-month S&P 500 earnings have soared from $243 at the start of the year to $254 currently. When companies post record profits, stock prices tend to follow suit, and we don’t think this time will be any different.

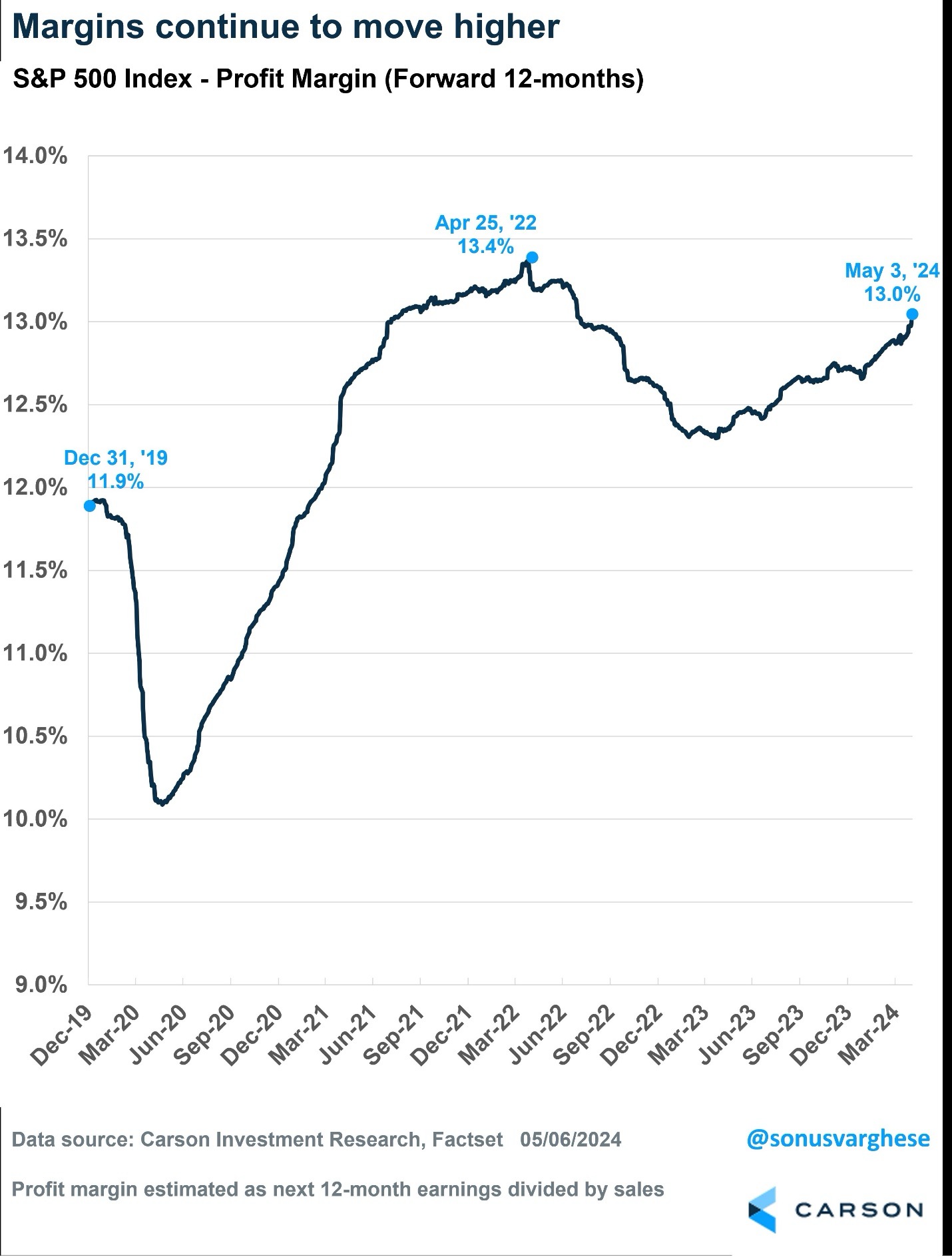

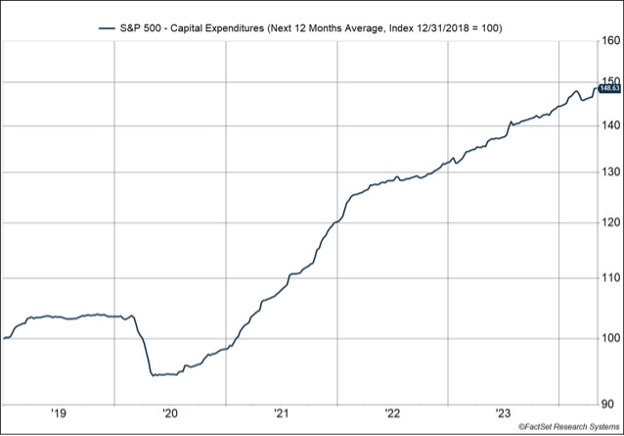

Profit Margins and CAPEX Continue to Improve

Related to earnings is profit margins, and stronger profit margins could be another reason to expect a stronger economy and bull market. While profit margins are improving due to cost-cutting, this will likely create a leaner and more agile corporate America the second half of this year.

While many have predicted profit margins have only one way to go — lower — the opposite continues to happen. Improving profits and profit margins supported by continued economic growth next year would provide a strong tailwind for equities.

Higher capital expenditures (CAPEX) are another positive. In fact, forward 12-month CAPEX is at an all-time high. Companies investing in themselves should lead to continued stronger productivity growth, which will likely help economic growth exceed expectations.

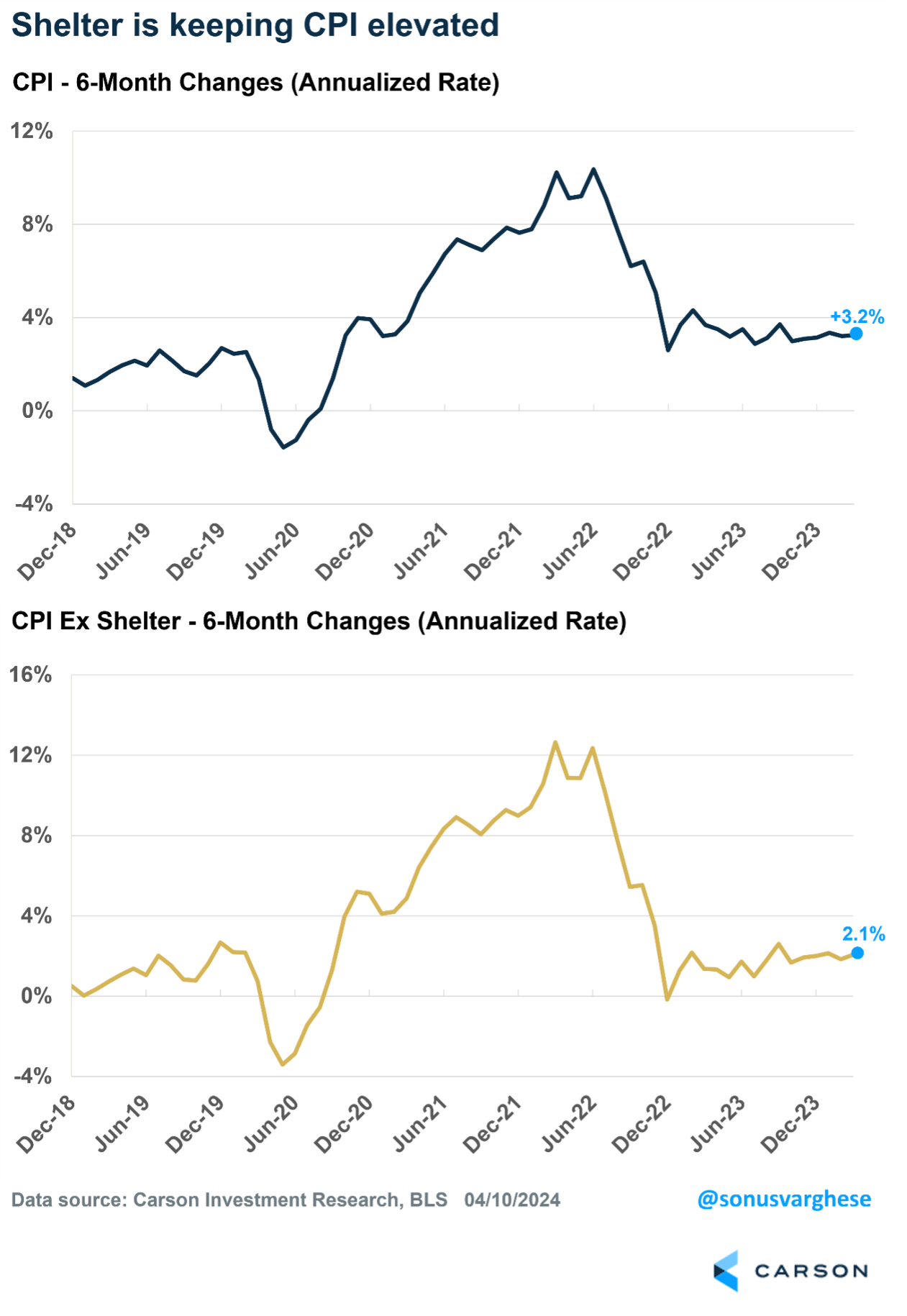

Improvement on the Inflation Front

Lastly, and maybe most importantly, inflation has improved over the past year. However, the last few months have shown that the path lower will have some bumps. We believe inflation will continue to improve, and the blip from earlier this year was a result of seasonal quirks and outliers, such as rising auto insurance and financial services fees, that are unlikely to persist.

Rents are falling in the private data, which gives a good estimate of prices for new or renewed leases. The rental price for a lease today is likely less than a similar lease over the last couple of years, but that has yet to flow to the government’s data, which includes all rents and shelter, even rent attributed to homeowners. Shelter makes up more than 40% of the core Consumer Price Index (CPI), so any improvement here will quickly influence CPI data. But while we’re waiting for overall rents to catch up with changes in asking prices seen in private data, such as from Apartment List and Zillow, it’s important to remember that if shelter is removed from CPI, inflation is running close to the Fed’s 2% target level.

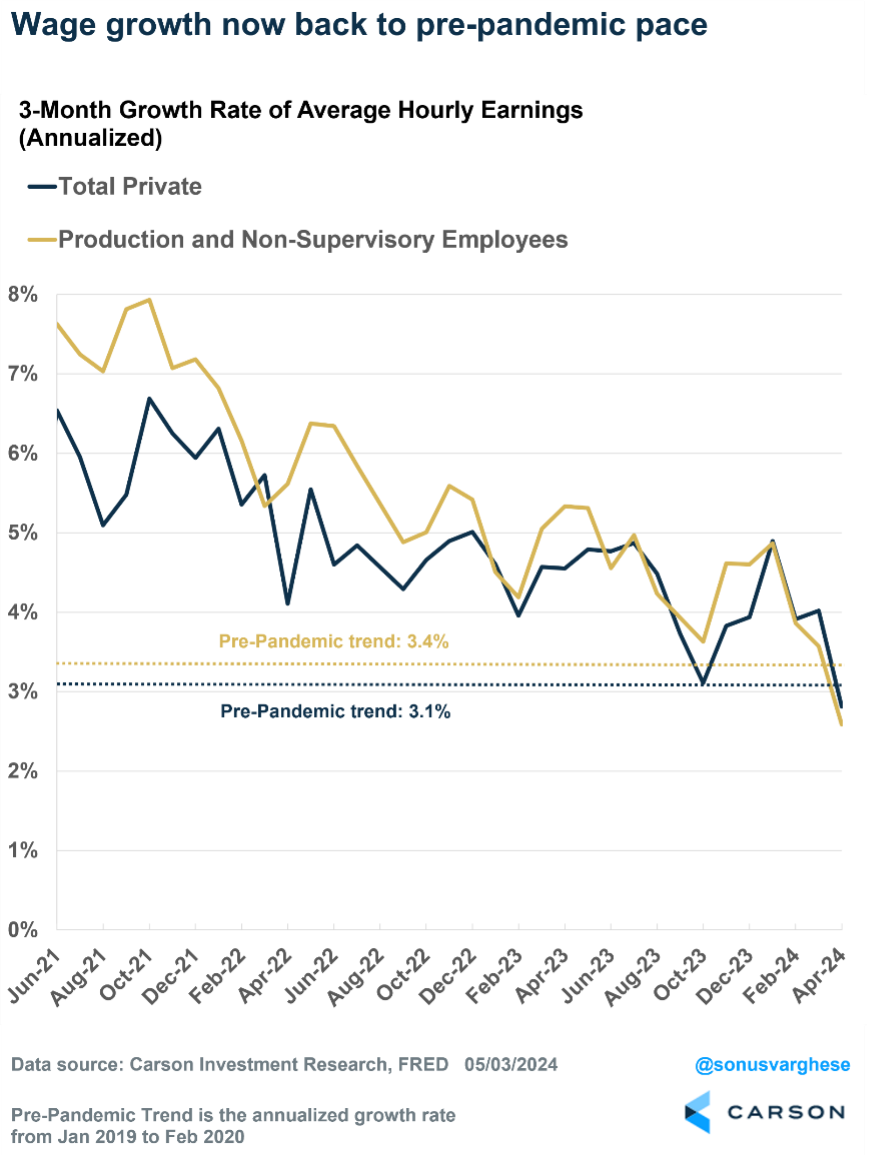

Some investors are concerned about higher wages impacting inflation, but we expect improvements over the coming months and quarters. The recent JOLTS data showed a healthy but normalizing labor market as wage growth slows. Similarly, the Indeed Wage Tracker showed slowing wage growth. In the high-inflation period of the 1970s, wage growth was up around 9%, which flowed through to overall inflation. Currently, wag growth is solid but more in the pre-pandemic range.

This is significant, as it sets the stage for the Fed to cut rates this year, likely two times. We started the year with markets anticipating six to seven cuts, but expectations then fell to one cut (with some calling for a hike). Just as the pendulum had swung too far toward too many cuts to start the year, we feel it has swung too far the other way now. With improving inflation data expected, the Fed should have the evidence it needs to cut rates, likely starting in September, or at the very least to push back on the hawkish rhetoric. Either could be a nice tailwind for equities.

We are aware of potential risks for the bull market. They will always be there, and we will continue to monitor them carefully. But the preponderance of evidence still points to continued strength despite the April market weakness. In fact, that kind of occasional weakness is an important part of a healthy market.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Compliance Case # 02236962_051324_C